A banking collapse would likely lead to Cyprus' exit from the eurozone. The ramifications of that are unknown.

LONDON (CNNMoney)

The European Union wants the beleaguered country to find nearly €6 billion to add to a €10 billion bailout program backed by the International Monetary Fund to save the country's insolvent banks.

And Cyprus is scrambling to put together a plan that will satisfy its would-be rescuers, while not further inflaming depositors.

Amid great uncertainty, one thing is clear -- the collapse of the tiny island nation's banks would lead the 17-member eurozone into uncharted waters.

Without agreement on a European rescue, emergency funding from the European Central Bank that has been keeping Cypriot banks afloat is due to end on Tuesday.

But will the ECB carry out its threat to yank the funding, knowing it would start a chain reaction that would almost certainly end in Cyprus abandoning the euro after just five years?

Some experts believe it will.

"Extending the emergency liquidity assistance without a clear deal could lead to a significant transfer of risk toward the ECB, and questions over its credibility," noted the Open Europe think tank.

"This would be a particularly poisonous debate in Germany, something which neither the ECB nor the German government would want."

Related: Cyprus sitting on natural gas gold mine

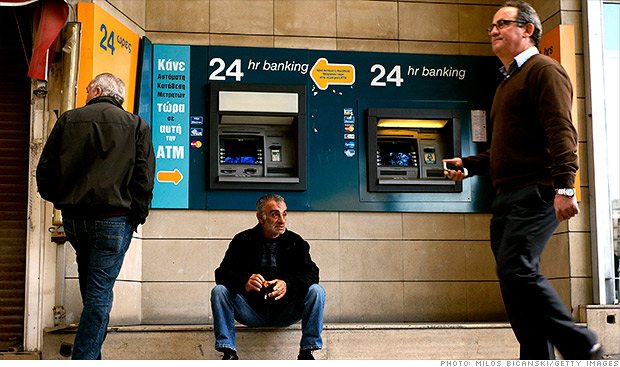

Banks in Cyprus have been closed to prevent a run on deposits after initial plans for a tax on all accounts -- since abandoned -- were revealed last weekend. ATMs have continued to function but long queues have formed at some banks.

In the absence of a rescue, Cypriots and foreign depositors will rush to withdraw cash as soon as they can. The government could extend the bank holiday again, and impose limits on financial transactions, but that would only delay the inevitable.

"The longer the restrictions on withdrawing and transferring assets continue, the more it increases the chances of drastic capital flight once they are lifted," wrote IHS Global Insight analyst Sean Harrison in a report.

Restricting the movement of capital wouldn't solve the country's banking crisis but only further depress activity in a recession-hit economy dependent on financial services and tourism, exacerbating the government's debt crisis.

Cyprus could close its two weakest banks -- it is already working on a plan to restructure one of them, Popular Bank of Cyprus -- but depositors would face big losses, further undermining confidence in the system as a whole.

Unable to restore trust in its banks and with an economy locked in a downward spiral, social and political unrest would escalate quickly. At that point, Cyprus may decide it has no option but to abandon the euro and start printing its own currency.

A new Cyprus pound would be worth much less than the euro, imposing even more pain on depositors than the original bank levy rejected by parliament on Tuesday.

What would a Cyprexit mean for the eurozone?

"If a collapse were to occur, we maintain our view that Cyprus is so different from any other eurozone country and banking system that contagion is far from obvious," said Unicredit chief economist Erik Nielsen.

While European stock markets and the euro took a hit this week, government bonds in Italy and Spain held steady. And U.S. stock markets ended the week down a little less than 0.5%.

Still, it's possible the ECB could feel pressure to take emergency steps to prop up markets by, for example, purchasing government bonds.

Spain has secured an EU-backed bailout of its banking industry, and policymakers and investors appear at this point to be relaxed about the absence of a government in Rome, pointing to measures already taken to control its borrowing.

Some analysts believe it's more likely that another small eurozone country -- Slovenia -- could move center stage if Cyprus collapses.

Slovenia has an economy twice the size of Cyprus, but it has already been forced to bail out its banking sector, which is plagued by a high and rising rate of bad loans, and a new government may struggle to fund the recapitalization.

The International Monetary Fund says Slovenia may need to provide an extra €1 billion in capital for its three largest banks, at a time when the country's debt burden is rising due to a recession caused by poor export demand and austerity measures.

First Published: March 23, 2013: 7:17 AM ET

![]()