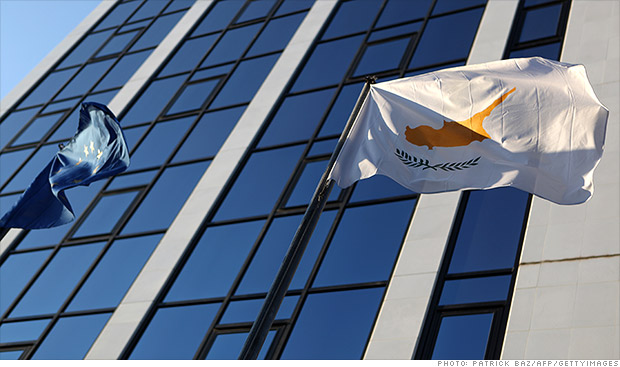

A bailout of Cyprus to rescue its huge banking sector is aimed at avoiding a default that could shake other weak eurozone states.

LONDON (CNNMoney)

The bailout, while small compared to the emergency loans supporting other troubled European nations like Greece, represents more than half the size of the €18 billion Cyprus economy.

Cyprus is the EU's smallest state, accounting for just 0.2% of output. But experts were worried that a default could destabilize the European financial system.

Indeed, the problem in Cyprus is the banking sector, which is several times the size of its economy.

In return for the bailout loans, Cyprus will impose a one-time tax on bank customers and their deposits.

The International Monetary Fund was expected to contribute to the deal as it has in others. Christine Lagarde, the fund's managing director, said in a statement that she supported the terms and would recommend that the IMF help provide financing for it.

Cyprus made a formal request for help last June after its banks were decimated by losses on Greek debt -- losses that caused lending to stall and sent the economy into a deep recession.

Over the course of last year, gross domestic product in Cyprus fell by 2.4%, and latest forecasts show further contraction this year and next.

Unemployment hit 12% last year and is forecast to rise to over 14% in 2014.

Negotiations on a bailout stalled last year after the previous government, led by Communist President Demetris Christofias, objected to the conditions that international lenders were looking to attach. They restarted following the election of a new center-right President Nicos Anastasiades last month.

Related: Europe financial sector is fragile, says IMF

The plan will leave the tiny island nation facing a more manageable debt burden. Its debt already stands at about 87% of GDP and is forecast to rise to 100% in 2020.

Russia has come to Cyprus' aid in the past, providing a €2.5 billion loan in 2011 to shore up government finances. Russia is expected to take part in the new rescue, possibly by extending its existing loan or reducing interest payments.

In addition to the tax on bank deposits, other conditions for the bailout loans include an overhaul of the financial sector and an increase in corporate taxes.

Cyprus is the fourth of 17 eurozone states to be granted a bailout by its EU partners and the IMF, after Greece, Ireland and Portugal. Spain has been given EU assistance to rescue its banks but has so far avoided asking for a full sovereign bailout.

Related: EU eases austerity demands for Portugal

More work will be needed before the bailout can be finalized, and some EU parliaments will have to ratify the deal, but analysts say the pressure to reach an agreement was high.

"Neither the Cypriot government, nor the eurogroup of EU finance ministers wants to see a eurozone member default, threatening catastrophic contagion for other financially troubled member states," IHS Global Insight country analyst Charles Movit wrote in a note last week.

Market confidence in the eurozone was briefly shaken again recently when Italian elections left the country with a hung parliament. Lack of a stable government would set back efforts to bring down Italy's debt mountain, the second largest in the eurozone after Greece. ![]()

First Published: March 16, 2013: 6:57 AM ET

Anda sedang membaca artikel tentang

Tiny Cyprus gets big EU bailout

Dengan url

http://bugarasakti.blogspot.com/2013/03/tiny-cyprus-gets-big-eu-bailout.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Tiny Cyprus gets big EU bailout

namun jangan lupa untuk meletakkan link

Tiny Cyprus gets big EU bailout

sebagai sumbernya

0 komentar:

Posting Komentar