Expiring drug patents are a thing of the past. Investors are taking notice.

LONDON (CNNMoney)

Investors have been piling into big pharma companies as worries about the expiration of lucrative patents and a thin pipeline of new drugs have receded, and as a desire for high-quality stocks with stable dividends has grown.

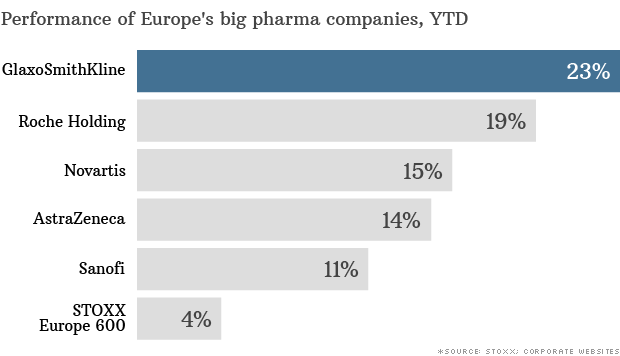

The STOXX Europe 600 Health Care index has rallied 15% since the start of January and easily outperformed the sluggish benchmark index, the STOXX Europe 600, which has nudged up by less than 4%. An ETF tracking the Health Care index has a dividend that yields nearly 2%.

Well-known names such as Switzerland's Roche and the U.K.'s GlaxoSmithKline (GSK) have been doing particularly well since the start of the year. Roche shareholders have seen the stock surge by roughly 19% and GSK shares have posted a 23% jump.

Prices for large-cap pharmaceutical stocks had been weighed down for years as companies braced themselves to lose their lucrative patents for blockbuster drugs. But now that those 'patent cliffs' have come and gone, investors are focusing more on growth opportunities and dividends.

"I think the run in pharma is going to continue," said Daniel Mahony, a London-based fund manager with Polar Capital who specializes in health care investments. "The patent cliff now is in the rear-view mirror for most companies. The question going forward is, 'where is growth going to come from?'"

The general consensus is that growth will come from the aging population in most developed economies combined with higher demand for healthcare in emerging markets.

Henderson fund manager John Bennett, who has funneled roughly 30% of his investments into European pharmaceutical companies, said that continued concerns about the industry and the expiration of drug patents were overdone.

"We may be only part way into what may turn out to be a decade-long bull market," he said in a recent research report.

Related: Hospitals profit more from surgical complications

Investors are also getting excited about new research and development efforts in the industry as companies increase their drug trials.

Naresh Chouhan, an equity analyst specializing in European pharmaceuticals at Liberum Capital, says R&D has significantly improved over the past few years, which could drive big pharma towards becoming a growth sector.

"Given that output in R&D is improving, the market is more willing to pay a higher multiple because the revenue seems more sustainable than it has done over the last five years," he said.

Worries about bloated R&D budgets are also a thing of the past.

"Commitment to R&D remains strong, but it is much more focused, leaner and efficient than it used to be," said Bennett.

When it comes to stock picking, Roche is a particularly hot investment right now, said Polar Capital's Mahony, who maintains shares are still relatively cheap despite the recent rally.

"The companies that are perceived to be the best innovators will outperform," he said.

Roche's drugs are also particularly difficult to copy, which makes them even more valuable from an investment standpoint, he said.

The current dividend yield for Roche shares is near 3.5%, which is roughly in line with the dividend yield for the rest of the big health care companies in Europe.

Sanofi (SNY) is another company that has the investment odds stacked in its favor, according to Morningstar equity analyst Damien Conover.

"Sanofi is well positioned to take advantage of the accelerating income in emerging markets because the firm has been entrenched in these regions for many years," said Conover.

Of course, the sector is not without its risks.

Scott Braunstein, portfolio manager for J.P. Morgan's global healthcare fund, said big pharma could face further pricing pressure in Europe and the U.S. as healthcare providers tighten their belts, a trend that could also be seen in emerging markets. ![]()

First Published: April 24, 2013: 3:37 AM ET

Anda sedang membaca artikel tentang

European drug stocks are on a tear

Dengan url

http://bugarasakti.blogspot.com/2013/04/european-drug-stocks-are-on-tear.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

European drug stocks are on a tear

namun jangan lupa untuk meletakkan link

European drug stocks are on a tear

sebagai sumbernya

0 komentar:

Posting Komentar