The market rally has entered a new phase.

(Money Magazine)

The short answer: not yet.

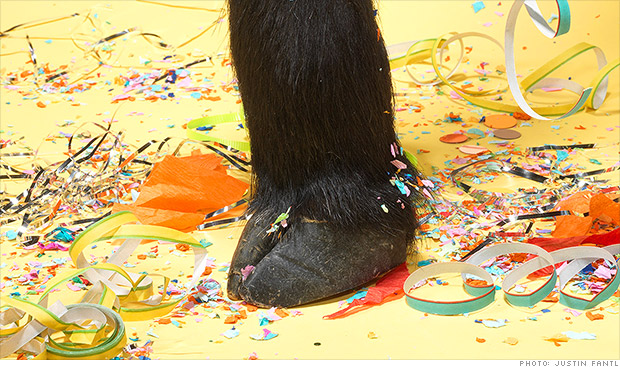

The bull isn't dead yet

By historical standards, this aging rally still has room to run.

| GDP growth | 2.8% | 4.2% |

| Investor bullishness | 36% | 57% |

| Age of recovery | 51 months | 58 months |

NOTES: Since 1948

SOURCE: S&P Capital IQ

On the one hand, "we're getting signals that the economy here and globally may be capable of accelerating," says Bruce Bittles, chief investment strategist at R.W. Baird.

The Federal Reserve recently cited "improvement in economic activity and labor market conditions" since it began its unprecedented bond-buying program to stimulate growth. Equally bullish is the fact that nothing in the economy is overheating. The Fed says it wants to see more signs that growth is sustainable before it cuts back on aggressive stimulus.

Still, you can already tell that the bull market is entering a different phase. Among the signs: Defensive, dividend-paying stocks that do well in the middle stages of a recovery are giving way to economically sensitive investments now that investors are more confident that the rebound is firmly in place.

And as corporate profit growth slows, valuations are inching higher. The price/earnings ratio for stocks in the S&P 500 index has climbed to 17.9, a hair below the 18.1 average at past market tops.

Rising valuations and the shift to a higher-gear economy mean the party is getting old. Here's how to position your portfolio for the bull's last dance or two.

Bet on the U.S. economy

Traditional growth sectors often do best in the final stage of a bull. But which growth sector should you favor now? Start with tech, through a fund like T. Rowe Price Global Technology (PRGTX).

Related: Investing in mutual funds

Brad Sorensen, director of market and sector analysis at the Schwab Center for Financial Research, says tech will be one of the prime benefactors of increased corporate spending. "Companies have been delaying capital expenditures, but to stay competitive on a global level they need to invest in equipment," he says.

Revenue growth will be key. Profit margins have probably peaked, and valuations have already risen. "For stocks to move higher from here, it has to come from sales," says Eric Vermulm, senior portfolio manager at Stack Financial Management.

Global Technology is particularly attractive on this front. The average holding in the fund, which has beaten 90% of its peers over the past three years, enjoys double-digit annual sales growth -- versus less than 3% for the S&P 500.

Mind your multiples

For starters, think big. That may seem counterintuitive, since history shows small-company shares often do well in the final phase of a bull, when confidence in the economy can lead to euphoria. Plus, S&P 500 valuations are rising.

Small-cap valuations, though, have been climbing even faster. Doug Ramsey, chief investment officer at the Leuthold Group, notes that small-caps now trade at a P/E, based on five-year averaged earnings, that's 23% higher than that of large-cap shares. Historically they've traded near parity.

Related: Rich investors sitting on a pile of cash

Also, look abroad. Foreign developed markets typically sell at a P/E in line with U.S. stocks. But today shares of companies based in Europe trade at a 35% discount. You can boost the value quotient even higher through a bargain-hunting fund such as Oakmark International (OAKIX), with 73% of its assets held in European shares.

Time to harvest some losses

The bull's final phase doesn't just present you with opportunities to buy; it's also a good time to sell.

You're probably sitting on some losers this year. As interest rates have risen, emerging-markets stocks, government bonds, and commodities have all taken a hit. Plus, more than 20% of the nearly 17,000 stocks that Morningstar tracks are down at least 10% this year, says Christine Benz, Morningstar's personal finance director.

Sell now and you can use those realized losses to offset capital gains you'll incur in your taxable accounts when you reposition your portfolio for an aging bull that has one last leg to go. ![]()

First Published: November 11, 2013: 4:56 PM ET

Anda sedang membaca artikel tentang

The bull parties on...for now

Dengan url

http://bugarasakti.blogspot.com/2013/11/the-bull-parties-onfor-now.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

The bull parties on...for now

namun jangan lupa untuk meletakkan link

sebagai sumbernya

0 komentar:

Posting Komentar