Critics point out that stock index funds have a knack for loading up on frothy investments at the worst possible times.

(Money Magazine)

An index fund, of course, buys and holds all the stocks listed on an index, like the S&P 500 -- but it's not quite that simple. Most indexes are weighted by capitalization so that they hold more of whatever the market assigns the most value to. That makes them, in part, a popularity contest.

Managers find an edge with bonds

The case for indexing isn't as strong for bonds as for stocks.

| Actively managed funds that beat indexes, past 3 years |

| U.S. large companies | 14% |

| U.S. small companies | 17% |

| Government bonds | 41% |

| Corporate bonds | 63% |

| Munis | 56% |

| Global bonds | 54% |

Note: As of Dec. 31 Source: Standard & Poor's

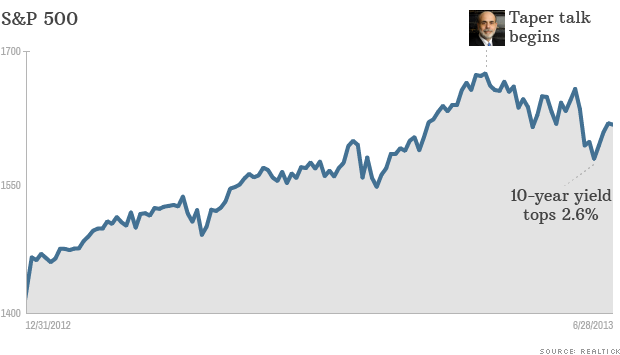

Critics have long pointed out that stock index funds have a knack for loading up on frothy investments at the worst possible times. Now a related critique is coming from a source who is hard to dismiss.

Vanguard founder Jack Bogle, who started the first retail index mutual fund, has recently been critical of bond market indexes. Again, it comes down to weighting. He says indexes have forced so-called total bond market funds to hold too much U.S. Treasury and government-related debt just when those securities are yielding next to nothing.

Related: Champion of the small investor - Jack Bogle

The fact that Bogle is questioning the suitability of an index investment that millions of investors use prompts the question, Is it time for you to rethink indexing?

MONEY has long been an advocate of low-cost index funds. After reexamining the case for passive investing and looking especially hard at its weak points, three guiding principles emerged:

No. 1: With U.S. stocks, indexing is very, very tough to beat.

Despite weighting issues, indexing starts with two huge advantages. The first is that investing is a zero-sum game of sorts. The investors who manage to outsmart the market have to be matched by other investors who got outsmarted. Over time, in this highly competitive game, it is very hard to identify fund managers who will be consistent winners.

The second is that index funds keep costs extremely low -- you can buy a traditional cap-weighted index exchange-traded fund for under 0.1% a year, vs. more than 1% for the average actively managed domestic stock fund.

Most managers can't beat the market by enough to surpass their fee. Over the past three years, just 14% of large-cap funds pulled it off.

Action plan: Use total stock market index funds for your core holdings in equities. You can cover the broad spectrum of domestic and foreign stocks with just two funds: Schwab Total Stock Market Index (SWTSX) (expense ratio: 0.09%) and Vanguard FTSE All-World ex-U.S. ETF (VEU) ( 0.15%). Both are members of the MONEY 70, our list of recommended mutual and exchange-traded funds.

You can even add stakes in more targeted index funds that help you meet specific needs.

For example, if you're older and seeking income, you may tilt toward dividend-paying stocks by adding to your core Vanguard Value ETF (VTV) (0.10%), which holds lower-priced stocks with an average yield of 2.5%.

"Pick your own asset-allocation strategy, and then you can use index funds to implement it," says New York City financial planner Lew Altfest.

No. 2: Index funds can still get into bubble trouble.

"What a traditional cap-weighted index represents is the market's equilibrium -- the prices buyers and sellers have agreed on for every security in the market," says Joel Dickson, a senior strategist with Vanguard. Yet the market sometimes collectively gets things wrong. Think back to the tech bubble in the late 1990s, when that sector grew to be more than a third of the entire U.S. stock market as a result of the mania in Internet stocks.

Today, a worry has arisen about emerging-markets index funds, which recently held nearly half of their assets in companies based in the so-called BRIC economies -- Brazil, Russia, India, and China. There's no telling whether the market's current judgment will seem wise in hindsight. But it's fair to say that a broad emerging-markets index concentrates risk in a narrow group of countries.

Action plan: Avoiding lopsided exposure is straightforward on the international side. Advisers recommend spreading your bets beyond just the BRICs into other markets, such as Indonesia and Mexico.

To do that, keep your current investment in a broad emerging-markets fund. With new money, though, add a fund that weights differently, such as iShares MSCI Emerging Markets Minimum Volatility (EEMV) (0.25%) with a third less in the BRICs than the standard emerging-markets index.

How to avoid bubble exposure in U.S. indexes is less settled. Some index critics have designed their own alternative "fundamental" indexes, which are supposed to correct the tendency to load up on hot stocks.

Related: ETF finder

For example, PowerShares FTSE RAFI U.S. 1000 (PRF) (0.39%) weights not by a company's stock market value, but by dividends, sales, and other indicators of business strength. Rob Arnott of Research Affiliates, which oversees the RAFI index, says his benchmark "has a pronounced value tilt" -- that is, to stocks that are relatively unloved.

In theory, this should mute the effects of momentum-driven bubbles. Yet fundamental funds ran into their own problems in 2008 -- they were loaded up on financial stocks heading into the crisis. They are also more expensive than their traditional counterparts.

You can almost as easily tilt away from go-go stocks by adding an indexer restricted to value, such as the Vanguard Value ETF (VTV), or small companies, like Vanguard Small Cap ETF (VB) (0.10%). (Bubbly stocks don't stay small for long.)

No. 3: Handle bond indexes with care.

Indexing fixed income has never been as simple as it is with equities. For starters, "you've got the 'bums' problem," says Paul Kaplan, director of research at Morningstar Canada and an indexing expert.

With stocks, capitalization weighting means loading up on the market's biggest winners. With bonds, this approach calls for betting big on the market's biggest debtors. Global bond index funds end up overweighting government bonds from Japan and Western Europe.

Related: The missing bond funds in your 401(k)

Here at home, U.S. Treasuries and government-related debt now make up more than 70% of the Barclays U.S. Aggregate bond index, with corporates representing less than 25%. Bogle thinks the Barclays aggregate bond index is flawed because it reflects not only bond purchases of investors but also those of foreign governments like China that are buying Treasuries more for policy purposes, not just because they think Treasuries are a great investment.

He argues that once you strip away government and central bank purchases of Treasury debt, government securities probably make up about a third of the U.S. debt market.

Action plan: A simple solution is to take half of your stake in a total bond market index fund and use that to buy a corporate bond index fund, such as Vanguard Intermediate-Term Corporate Bond Index (VCIT) (0.12%). The combination of the two will give you a portfolio that's about two-thirds corporates and one-third governments. Alternatively, consider an active fund with a long track record of spotting bond values, such as Loomis Sayles Bond (LSBRX)( 0.92%).

Overseas, it's a tougher challenge. There are few index funds that give you exposure to the broad array of governments and corporates in both the developed market and the emerging world.

As a result, you're better off anchoring your overseas bond holdings with an actively managed fund like MONEY 70 recommendation Templeton Global (TPINX) ( 0.89%), whose top weightings are in low-debt nations like Poland, Mexico, South Korea, and Ukraine. Compare that with the Barclays Global non-U.S. Treasury index, whose top holdings are from Japan, with a sky-high debt-to-GDP level of about 212%. Talk about lopsided.

First Published: July 1, 2013: 6:10 PM ET

![]()