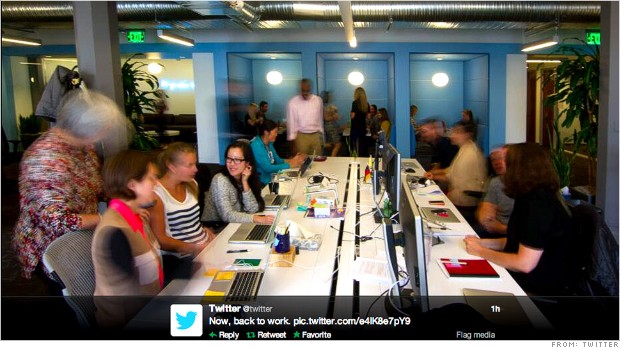

After the announcement, Twitter sent sent out this photo, along with the note: "Now, back to work."

NEW YORK (CNNMoney)

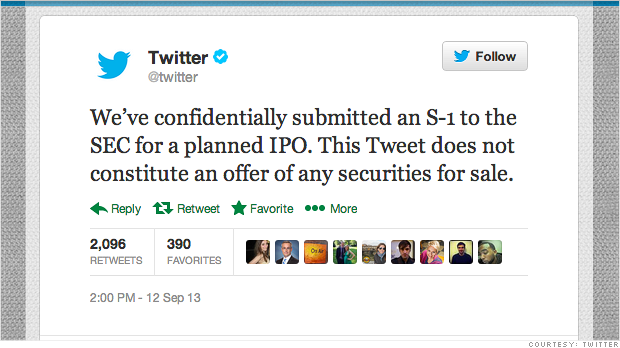

How did Twitter do that? And why?

It's all thanks to the Jumpstart Our Business Startups, or JOBS Act.

The law, passed in 2012, applies to so-called emerging growth companies, those with up to $1 billion in annual revenue. Filing in such a way lets companies:

- Test the waters: Twitter executives can quietly approach select investors and gauge their interest without worrying about receiving any pressure from media or analysts.

- Buy time: Getting started in secret gives Twitter a few more weeks -- or months -- to build up its advertising strategy without revealing its finances.

- Show less paperwork: The company doesn't have to expose its books as much as it would in a traditional IPO. Under the new rules, only two years of financial statements need to be audited instead of the usual three.

Related: Twitter files for IPO

The goal of an IPO is to raise money, and Twitter won't be able to start doing that just yet. The company will eventually need to file a public registration statement 21 days before kicking off its fund-raising roadshow.

Another benefit: That helps the company get things in order before becoming the center of attention.

"It allows them to work out any significant issues the SEC might have with their accounting before it sees the light of day," said Ira Rosner, a securities lawyer with Greenberg Traurig.

In a typical IPO, investors see the back and forth with the SEC -- with potentially embarrassing results.

Twitter isn't alone in its approach. The use of confidential IPOs has been on the rise ever since the JOBS Act was passed. Manchester United (MANU) did it last year, as did SolarCity (SCTY), Trulia (TRLA) and GlobeImmune (which isn't listed yet).

Confidential filings have outpaced regular IPOs two to one. Approximately two-thirds of the 131 IPOs priced so far this year have come from confidential filings, according to Renaissance Capital. ![]()

First Published: September 12, 2013: 7:07 PM ET