NEW YORK (CNNMoney)

Among 60-to-65 year olds, 30% have invested almost all of their savings in stocks, while 52% have more than 70% of their nest egg in stocks, according to an analysis of 10,000 users (split among three different age groups) of FeeX, which helps users find lower investment fees.

That's a risky move.

For a well-balanced portfolio, financial planners say that savers in this age group should have no more than 60% of their assets in stocks. The rest should be split among more conservative assets like bonds and money market funds that can cushion the blow of sell-offs like the one we're currently in.

Related: Asset allocation: Fix your mix

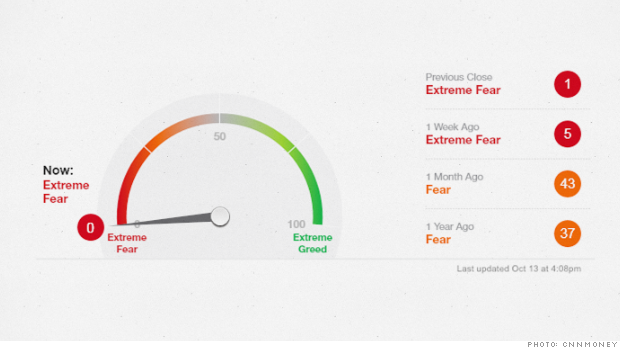

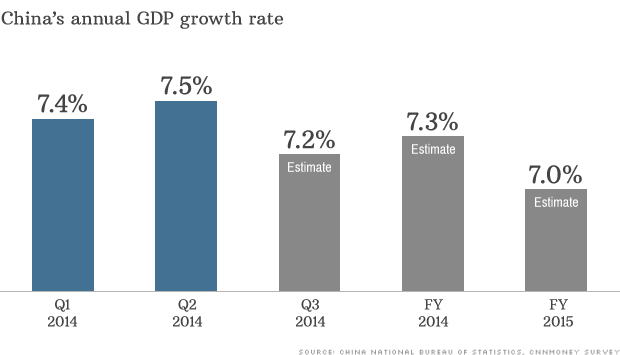

Amid fears surrounding Ebola and slowing global growth, both the S&P 500 and Dow Jones Industrial Index are down more than 5% from a month ago, and some experts say it could signal the start of a market correction, when the market drops by at least 10%.

While there's no way to know which direction stocks will go, older investors simply don't have the time to ride out such big market fluctuations.

"If you're a couple of years away from retirement, you're really rolling the dice at the Roulette table," said Erik Laurence, vice president of marketing and business development at FeeX.

Related: What the heck should the Fed do now?

When stocks are plunging, age-appropriate allocations can help shield older investors from such steep losses, said Scott Tiras, a Houston-based Ameriprise financial adviser who works mainly with older clients.

"Diversification is so important...especially for someone who is going to be dependent on that portfolio sooner rather than later," he said.

So what's an overexposed Boomer to do?

Now is the time to check those 401(k) statements closely and make sure you have the appropriate asset mix. To help you figure out what that mix should be, try taking this risk tolerance quiz or using our asset allocation calculator.

If you find that you're too heavily weighted in stocks, let the current market volatility serve as a friendly reminder to put a more conservative strategy in place.

Related: Get your assets in gear! Find the right investment mix

Yes, that may mean selling at a loss compared to a few months ago. But stocks are still relatively flat for the year. And they're leaps and bounds higher than they were in 2008.

Of course, you could also hold tight and see what happens in coming weeks and months. But in that case, "the market might do the re-balancing for you," said Judith Ward, a senior financial planner at T. Rowe Price.

First Published: October 16, 2014: 6:30 PM ET

Barista Kirstie Ponce showing off her tattoos.

Barista Kirstie Ponce showing off her tattoos.

Amazon needs some extra help to sort all those boxes.

Amazon needs some extra help to sort all those boxes.